(Bloomberg / Forexpediaa News) The U.S. labor market may not be as soft as recent employment data suggest. According to a new analysis from the Federal Reserve Bank of Dallas, the slowdown in monthly job gains should not be interpreted as a sign of weakness, but rather as evidence of a rebalancing labor market amid moderating immigration trends and a cooling post-pandemic economy.

Recalibrating the Labor Market

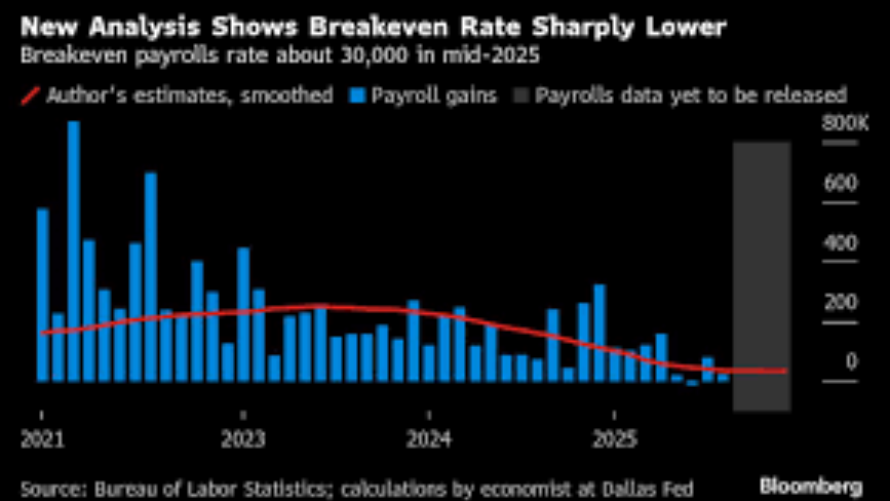

The Dallas Fed’s research highlights a significant shift in what economists call the “break-even employment rate” the number of new jobs the economy must generate each month to keep the unemployment rate steady. That figure has plummeted to about 30,000 as of mid-2025, compared with an estimated 250,000 in 2023, when immigration surged following pandemic disruptions.

The analysis attributes this decline to the ebb and flow of immigration. After a sharp rise in 2022 and 2023 that temporarily boosted labor supply and fueled strong job creation, immigration began to reverse in mid-2024, slowing the overall growth of the U.S. workforce.

“This recalibration suggests that today’s more modest payroll gains don’t signal weakness but are consistent with a balanced labor market,” wrote Anton Cheremukhin, Principal Research Economist at the Dallas Fed, in a blog post published Thursday.

Fewer Jobs, Still Stable Unemployment

The findings challenge the prevailing narrative that slower job growth automatically points to an economic slowdown. With fewer new workers entering the labor force, the U.S. no longer needs massive payroll expansions to maintain stable unemployment levels.

This dynamic is key for investors tracking Federal Reserve policy. A balanced labor market implies lower inflation pressures, potentially allowing the Fed to continue its cautious path toward interest rate cuts a factor with direct implications for forex trading strategies, indices trading, and global crypto market performance.

As the Fed weighs further easing in late 2025, traders across asset classes are watching the labor data closely. Lower job creation paired with stable unemployment could be a signal that the Fed’s tightening cycle has achieved its soft-landing objective without triggering a recession.

Implications for Traders and Investors

For investors, this shift in the labor market’s dynamics underscores the importance of macroeconomic adaptation. In forex trading, a rebalanced U.S. labor market could translate into a more predictable U.S. dollar trajectory, especially if markets interpret steady unemployment and easing inflation as signs of sustainable growth.

Indices trading participants may also see this as supportive for equities, as stable employment and moderating inflation tend to underpin corporate earnings and broader risk sentiment. Meanwhile, crypto investors are paying close attention to how monetary policy evolves from here since shifts in U.S. interest rates often drive liquidity cycles that shape crypto market volatility and valuation trends.

In the context of crypto investment, macroeconomic clarity is increasingly relevant. A steadier job market and gradual rate adjustments could support a renewed appetite for digital assets as risk-on sentiment returns.

Balancing Growth and Stability

The Dallas Fed’s findings come at a pivotal moment for policymakers and investors alike. While the U.S. economy remains resilient, the pace of job creation has slowed notably in recent months, leading to speculation about potential cracks in the labor market. However, the Dallas Fed’s data suggest a more balanced interpretation: the U.S. may simply be settling into a sustainable post-pandemic employment rhythm.

With inflation easing and hiring normalizing, the overall macroeconomic picture may continue to support measured optimism across both traditional and digital markets. Whether in forex trading, indices trading, or crypto investment, understanding the link between labor market dynamics and monetary policy will be crucial for navigating the months ahead.