Back-to-back calls between U.S. President Donald Trump and the leaders of Japan and China have so far done little to defuse the diplomatic spat occurring between Beijing and Tokyo, as experts warn that a de-escalation of the crisis remains nowhere in sight a situation closely watched by global investors, especially those involved in crypto investment, forex trading strategies, indices trading, and the broader crypto market.

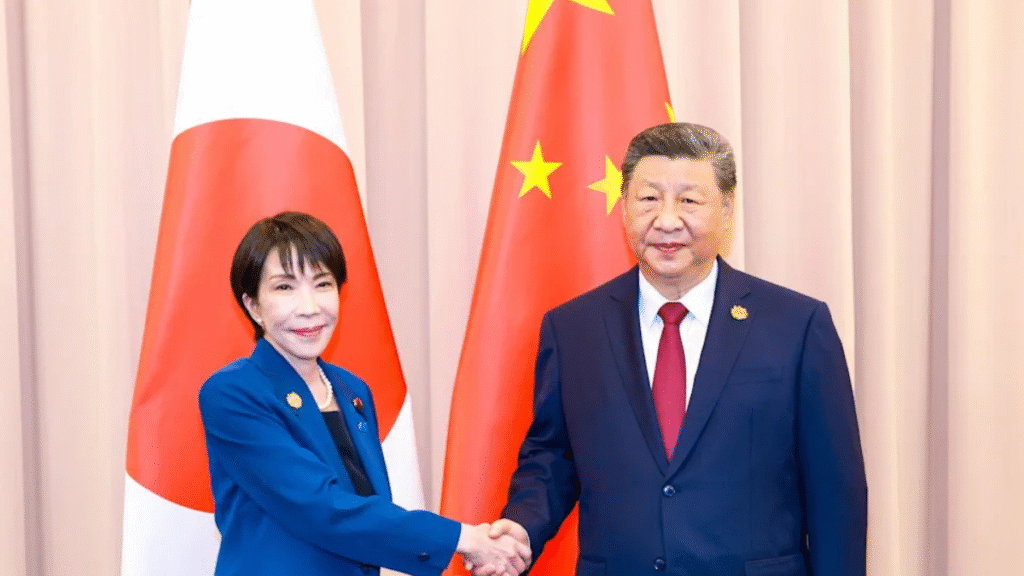

Japanese Prime Minister Sanae Takaichi spoke with Trump on Tuesday, hours after he held a separate call with Chinese President Xi Jinping.

Takaichi said that she discussed China relations during their conversation. The flurry of calls followed a dispute triggered by Takaichi’s recent remarks over how Japan might respond to a Chinese attack on Taiwan a geopolitical risk that often influences forex trading strategies and indices trading across Asia.

Xi pressed Trump on Taiwan during their Monday call, urging Washington to help safeguard the international order post-World War Two, according to an official readout.

Trump, however, did not mention Taiwan publicly. The U.S. President simply said they discussed Ukraine, fentanyl, and soybeans. He will visit Beijing in April, with Xi expected to visit the U.S. in 2026 developments observed closely by markets, including the crypto market, which reacts sharply to geopolitical uncertainty.

The Wall Street Journal reported Tuesday that Xi had taken the unusual move of requesting the call with Trump.

Experts say the Chinese statement emphasized Taiwan, suggesting Xi wants Trump to use his influence with Takaichi to tone down her rhetoric on cross-Strait issues.

Beijing has demanded that Takaichi retract her statement on Taiwan, but while the Japanese prime minister said she would avoid discussing specific scenarios in the future, she has not withdrawn her remarks.

“Takaichi cannot retract her statement and Beijing knows that… As long as Takaichi remains prime minister, it’s hard to see relations improving much,” analysts at Eurasia Group said.

Alice Han of Greenvale said Xi “prioritizes Taiwan as part of his legacy,” while Trump’s administration appears more reluctant to become deeply entangled in Taiwan security matters, focusing instead on the economic relationship a shift that also impacts crypto investment sentiment and forex trading in the region.

Washington’s silence

Beijing’s outreach represents an unusual opening as it seeks U.S. intervention to rein in tensions with Japan. However, Trump has stayed publicly silent.

Analysts warn that this silence is concerning for Taipei and Tokyo.

Beijing has also attempted to apply economic pressure on Japan, including restrictions on seafood imports, travel advisories, and warnings to Chinese residents in Japan moves that historically ripple into financial markets, influencing indices trading and cross-border crypto investment flows.

Even as economic pressure builds, analysts say both sides want to avoid military conflict, keeping the risk of unintended confrontation low. Still, bilateral relations are unlikely to improve soon, citing past examples of Chinese coercion against South Korea and Australia, which took years to resolve.

Recent diplomatic outreach from Japan has so far yielded no results, with Beijing making it clear that there is “no room for compromise.”

Experts say the crisis is likely to persist and global markets, including the forex, indices, and crypto market, will continue to respond to the unfolding geopolitical tension.