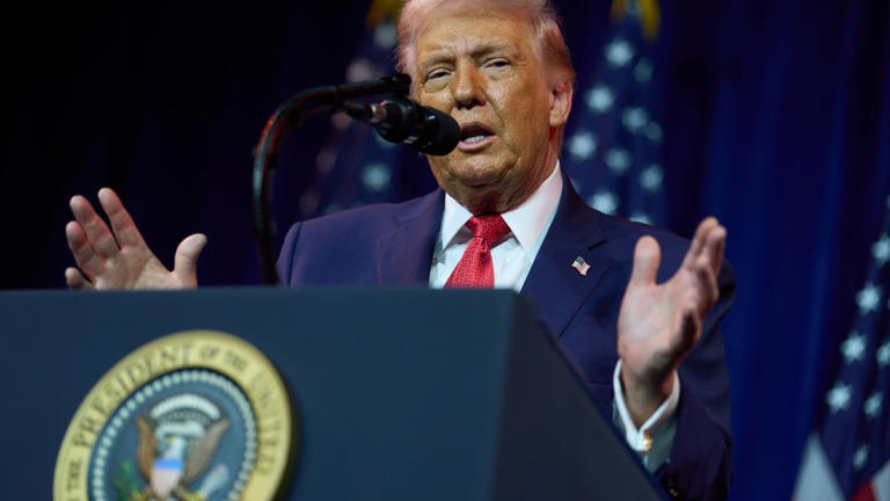

WASHINGTON (AP) President Donald Trump on Wednesday proposed raising U.S. military spending to an unprecedented $1.5 trillion in 2027, warning that the nation faces “troubled and dangerous times” amid escalating global tensions.

The proposal comes just days after Trump ordered a U.S. military operation that led to the capture of Venezuelan leader Nicolás Maduro, who was transported to the United States to face drug trafficking charges. U.S. forces continue to build up their presence in the Caribbean Sea, adding to concerns about rising geopolitical instability.

For comparison, the 2026 U.S. defense budget stands at $901 billion, meaning Trump’s proposal represents a dramatic surge in military outlays.

Geopolitical Tensions Drive Spending Push

In recent days, Trump has intensified his foreign policy rhetoric, calling for U.S. control of Greenland for national security reasons and suggesting openness to military operations in Colombia. Secretary of State Marco Rubio has also issued warnings about Cuba, saying the longtime U.S. adversary “is in trouble.”

“This will allow us to build the ‘Dream Military’ that we have long been entitled to and, more importantly, that will keep us SAFE and SECURE, regardless of foe,” Trump said in a post on Truth Social announcing the proposal.

The Pentagon recently received an additional $175 billion under a sweeping GOP-backed tax and spending package signed into law last year, further expanding defense resources.

Political Resistance Expected

Trump’s call for expanded military funding is expected to face resistance on Capitol Hill. Democrats have long argued for parity between defense and non-defense spending, while Republican deficit hawks have pushed back against ballooning federal expenditures.

However, Trump argued that increased revenues from tariffs imposed on both allies and rivals since his return to office give him room to expand defense spending.

According to the Bipartisan Policy Center, the U.S. collected $288.5 billion in revenues last year from tariffs and excise taxes up sharply from $98.3 billion in 2024. Still, analysts note that the increase falls short of covering Trump’s broader fiscal promises, which include debt reduction, taxpayer dividends, and expanded military investment.

Pentagon Targets Defense Contractors

Alongside the spending proposal, Trump issued a sharp warning to Raytheon, one of the largest U.S. defense contractors. He threatened to cut off Pentagon contracts if the company continues stock buybacks instead of reinvesting profits into weapons manufacturing capacity.

“Either Raytheon steps up and starts investing in more upfront investment like plants and equipment, or they will no longer be doing business with the Department of War,” Trump wrote on social media.

The president also signed an executive order directing the Pentagon to review contractors that are underperforming on government contracts while still engaging in stock buybacks or issuing dividends. The order calls for future contracts to prohibit buybacks during periods of underperformance and to decouple executive compensation from short-term financial metrics.

Raytheon produces several critical weapons systems, including Tomahawk cruise missiles, Javelin, Stinger, and Sidewinder missiles, and owns Pratt & Whitney, which manufactures engines for military aircraft such as the F-35 Joint Strike Fighter.

Market Reaction and Trading Implications

Wall Street reacted swiftly to Trump’s comments. Shares of major defense contractors declined, with Northrop Grumman falling 5.5%, Lockheed Martin down 4.8%, and RTX Corp., Raytheon’s parent company, slipping 2.5%.

For global investors, the surge in military spending and rising geopolitical risks could have broader implications across asset classes. Heightened uncertainty often influences forex trading strategies, impacts indices trading, and increases market volatility.

Periods of elevated defense spending and global tension also tend to drive interest in alternative assets, pushing some investors toward crypto investment as a hedge. As a result, geopolitical developments like these frequently ripple into the crypto market, alongside traditional financial markets.

For traders and investors, Trump’s proposed defense expansion highlights how political and military decisions remain powerful catalysts across forex, equity indices, and digital assets.